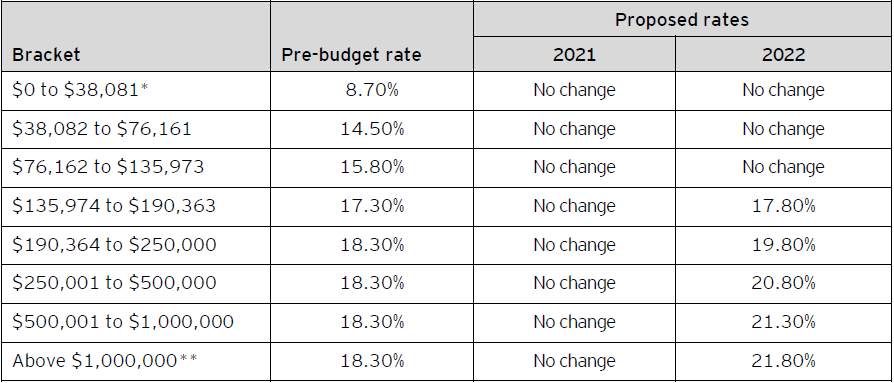

Tax deductions specified under Chapter VIA of the Income Tax Act What are the tax brackets for 20 tax brackets have been changed since 2021 to adjust for inflation.It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. Interest on loan u/s 24(b) allowable is tabulated below: Nature of PropertyĬonstruction or purchase of house property They are: 10, 12, 22, 24, 32, 35, and 37, depending on the tax bracket. However, this deduction is not available for person opting for New Tax Regime. In case of self- occupied property, the upper limit for deduction of interest paid on housing loan is ₹ 2 lakh. Section 24(b) – Deduction from Income from House Property on interest paid on housing loan & housing improvement loan. Investments / Payments / Incomes on which I can get tax benefit

#2022 vs 2021 tax brackets plus

Health & Education cess 4% shall also be paid on the amount of income tax plus Surcharge (if any) The amount payable as Surcharge shall not exceed the amount of income earned exceeding ₹ 50 lakh, ₹ 1 crore, ₹ 2 crore or ₹ 5 crore respectively Marginal relief is a Relief from Surcharge, provided in cases where the Surcharge payable exceeds the additional income that makes the person liable for Surcharge.

15% - Taxable Income above ₹ 1 crore - up to ₹ 2 crore.10% - Taxable Income above ₹ 50 lakh – up to ₹ 1 crore.Surcharge is an additional charge levied for persons earning Income above the specified limits, it is charged on the amount of income tax calculated as per applicable rates Central & State Government Department/Approved Undertaking Agency.Deductions on which I can get tax benefit.View how much tax you may pay in other states based on the filing status and state entered above. Here is a list of our partners who offer products that we have affiliate links for. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

Second, we also include links to advertisers' offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers' offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

#2022 vs 2021 tax brackets for free

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective.

0 kommentar(er)

0 kommentar(er)